There are millions of people all over the world who have become completely embroiled in debts in recent years, and the reason for this is mainly unplanned financial management. People do not spend in accordance with what they earn, the slow economic progress and mounting prices have resulted in people taking more and more loans. […]

A Definitive Guide to Hard Money Lending and Private Lending

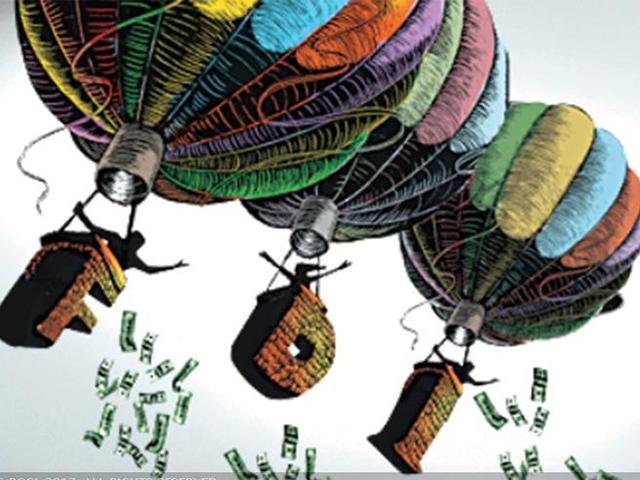

When it comes to securing standard loans, opting for the services of traditional lending institutions such as banks appears to be the ideal choice. However, often the traditional method of acquiring loans does not work, especially when it comes to the needs of small businesses. Startup businesses and other small business owners need a small […]

Tips To Get Hold Of A Lawyer Proficient In The Field Of Consolidating Your Debt Consolidation Loan

Falling victim to debt is a very major issue these days in the contemporary times when the economy is becoming trying than ever before. There are different types of job opportunities provided you are willing to explore the various job options. But when it comes to conventional and regular jobs, there is a significant crisis, […]

Getting A Secured Debt Consolidation Loan Can Be Quite Beneficial For Your Business!

It is quite likely that when you were younger, you must have heard of the old saying that unity will bring in more strength. This old popular saying has stood through the ravages of time because it is the truth. It is a fact that this statement and this idea are also applicable for repayments […]

Benefits of LLC Over Other Entities

Most people dream about opening their businesses in an area of field they love working in. When one gets serious about converting this dream into reality, one can do in many ways depending on the type of entity he chooses. Sole proprietorship, Limited Liability Company, Partnership, S-corporation etc. are some of the entities one can […]

FDI Combined Policy Comprises Startups

India revealed a fresh oversea direct spending policy structure. The policy structure for the first time includes terms specific to startups, a segment that is at pinnacle on the agenda of the government. This data was given by two sources having a deep knowledge of this matter to the media. The 2017 FDI strategy circular […]

Debt Consolidation Is A Smart Way to Solve Your Debt Issues

Sometimes overspending habits compels one at extreme that one never-mind in taking more and more debt. One day situation goes worse and dreams gets converted into nightmare. The person who borrow money to fulfil his dreams and his family wishes now feel frightened while sleeping. Debt leads one to a depressed life. It may be […]

Credit Card a Tool to Simplify Expenses but a Mess As Well

Today world believe in cashless transaction where credit cards are standing first. Few years ago master card and visa were in more fashion. Mostly banks used to offer these cards to their customers who had established accounts. Later platinum card, gold card, silver card came in fashion. All kinds of cards offers their customers certain […]

Need of Consolidation in Term of Credit Card Debt

Eventually when you go out, you notice that people are not using cheque or cash to pay anywhere. This is simply because of the increasing craze of cashless transaction. This is the reason why the number of credit card holders are increasing. The visa commercial countries deadly use this powerful plastic card. Credit cards are […]