The automotive glass market, once considered a simple commodity segment, has transformed into a critical hub of innovation and value creation within the global automotive industry. Far beyond just providing visibility and protection from the elements, modern automotive glass is integral to vehicle safety, connectivity, aesthetics, and energy efficiency. Driven by stringent safety regulations, the electric vehicle (EV) revolution, and consumer demand for advanced features, this market is experiencing a dynamic shift.

Market Overview and Growth Drivers

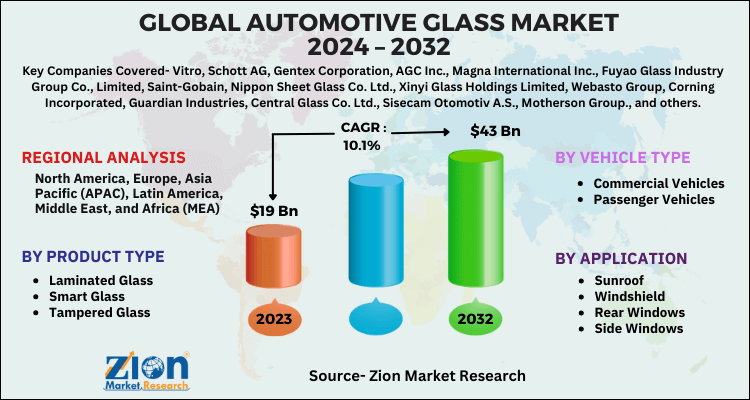

The global automotive glass market is on a steady growth trajectory, projected to reach a value of over USD 30 billion by 2030, with a compound annual growth rate (CAGR) of approximately 6-8%. This growth is fueled by several interconnected factors:

-

Safety Regulations as a Non-Negotiable Driver: Government mandates worldwide have made advanced safety glass compulsory. Laminated glass for windshields, which prevents shattering upon impact, is now standard. The push for pedestrian safety is also leading to the development of glass that can absorb impact energy more effectively. Regulations like the European Union’s General Safety Regulation (GSR) are accelerating the adoption of advanced driver-assistance systems (ADAS), which rely on perfectly calibrated glass for sensors and cameras.

-

The Electric Vehicle (EV) Revolution: EVs are fundamentally reshaping automotive design and component requirements. To maximize range, automakers are obsessed with weight reduction and aerodynamics. This drives demand for thinner, lighter, yet stronger glass. Furthermore, EVs often feature larger panoramic sunroofs and glass canopies to enhance space and consumer appeal, directly increasing the glass surface area per vehicle.

-

Rise of Advanced Driver-Assistance Systems (ADAS): The sensors, cameras, and LiDAR units that enable ADAS features like lane-keeping, automatic emergency braking, and adaptive cruise control are frequently mounted behind or within the glass. This necessitates high-precision, optically clear glass that does not distort signals. Any replacement requires meticulous re-calibration, adding value and complexity to aftermarket services.

-

Consumer Demand for Comfort and Connectivity: Modern consumers expect a seamless digital experience. This has given rise to smart glass technologies, such as:

-

Heated Glass: For defrosting windshields and wiper zones.

-

Solar Control Glass: Infrared-reflective coatings that keep interiors cooler, reducing AC load (crucial for EV efficiency).

-

Heads-Up Display (HUD) Glass: Specially wedged windshields that project information onto the driver’s field of vision.

-

Privacy & Dimming Glass: Electrochromic sunroofs that can tint on demand.

-

Key Market Segments

The market can be segmented in multiple ways:

-

By Glass Type: Laminated Glass (dominant for windshields) and Tempered Glass (used for side and rear windows).

-

By Vehicle Type: Passenger Cars, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). The passenger car segment, particularly premium and EVs, holds the largest share.

-

By Application: Windshield, Sidelite, Backlite, and Sunroof. The sunroof segment is the fastest-growing application.

-

By Sales Channel: Original Equipment Manufacturer (OEM) and Aftermarket. The aftermarket is significant due to the inevitable need for replacements from wear, tear, and accidents.

Competitive Landscape and Key Players

The market is characterized by a high degree of consolidation, with a few global giants holding significant market share. Competition is based on technology, quality, global supply chain, and partnerships with major automakers.

Leading Companies Include:

-

AGC Inc. (Japan)

-

Saint-Gobain (France)

-

Fuyao Glass Industry Group Co., Ltd. (China) – The world’s largest automotive glass supplier by volume.

-

Nippon Sheet Glass Co., Ltd. (Japan)

-

Guardian Glass (US)

-

Vitro (Mexico)

These players are heavily investing in R&D to develop lighter-weight materials (like polyvinyl butyral interlayers), advanced coatings, and integrated antenna systems within the glass.

Challenges and Constraints

Despite the positive outlook, the industry faces headwinds:

-

Raw Material Price Volatility: The cost of key materials like silica sand, soda ash, and PVB resin can fluctuate, impacting margins.

-

High Capital Intensity: Setting up and maintaining manufacturing facilities for high-quality automotive glass requires substantial investment.

-

Complex Integration: As glass becomes “smarter,” its integration with a vehicle’s electrical and electronic architecture becomes more complex, requiring deeper collaboration with automakers.

-

Aftermarket Calibration Complexity: The need for ADAS calibration after windshield replacement raises repair costs and requires specialized technician training, potentially slowing service turnaround.

Future Outlook: The Road Ahead

The future of automotive glass is transparent, connected, and intelligent. Key trends to watch include:

-

Full-Display Windshields: Evolving from HUDs, these will turn the entire windshield into an augmented reality display for navigation and safety alerts.

-

Glass as a Communication Hub: Integration of 5G antennas, V2X (vehicle-to-everything) communication modules, and improved GPS reception directly into the glass.

-

Photovoltaic Glass: Glass embedded with transparent solar cells to passively charge a vehicle’s battery, a game-changer for EVs.

-

Self-Healing and Self-Cleaning Coatings: Nano-technological coatings that repair minor scratches or repel water and dirt, enhancing durability and convenience.

Read More-

https://www.zionmarketresearch.com/de/report/lubrication-systems-market

https://www.zionmarketresearch.com/de/report/easy-open-packaging-market

https://www.zionmarketresearch.com/de/report/implantable-drug-delivery-devices-market

https://www.zionmarketresearch.com/de/report/fleet-management-systems-market

https://www.zionmarketresearch.com/de/report/automotive-glass-market

Conclusion

The automotive glass market is no longer just about looking out; it’s about looking ahead. It sits at the intersection of safety regulation, consumer experience, and technological innovation. As vehicles evolve into connected, autonomous, and shared platforms, the role of glass will only become more central. Companies that can innovate in weight reduction, optical clarity, and integrated functionality will not only see through the competition but will also help define the very landscape of future mobility.