The melanoma drugs market represents one of the most dynamic and transformative sectors in oncology. Once a disease with limited and often ineffective treatment options, advanced melanoma has become a proving ground for breakthrough therapies that have redefined cancer care. Today, the market is a high-stakes arena driven by immunotherapy, targeted therapy, and a relentless pursuit of longer survival and improved quality of life for patients.

Market Landscape: From Desperation to a Arsenal of Options

The shift began in the early 2010s with the arrival of immune checkpoint inhibitors (ICIs) and BRAF/MEK targeted therapies. These drug classes turned the tide, moving the treatment paradigm from chemotherapy with dismal outcomes to precision medicine and immune system activation.

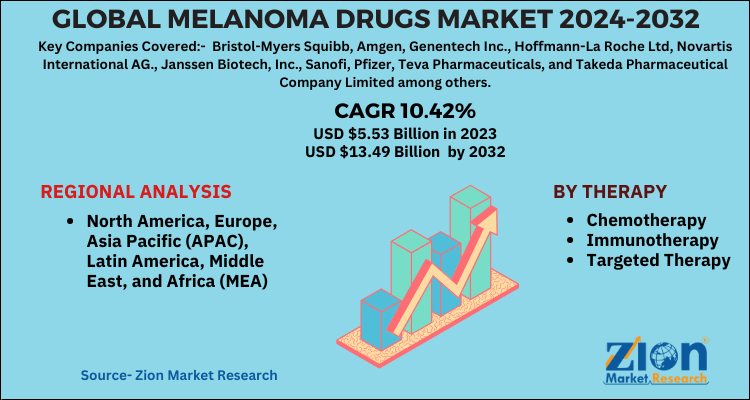

The global melanoma drugs market was valued at approximately $7.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8-10% through 2030. This growth is fueled by increasing incidence rates (particularly in North America and Europe), improved diagnostic capabilities, sustained innovation, and expanding treatment into earlier stages of disease (adjuvant and neoadjuvant settings).

Key Therapeutic Pillars Dominating the Market

-

Immunotherapy: The Unshakable Leader

-

PD-1 Inhibitors (Keytruda® (pembrolizumab), Opdivo® (nivolumab)): These are the cornerstone of first-line treatment for many patients, blocking a pathway cancer uses to hide from the immune system. Their success has established a dominant market share.

-

CTLA-4 Inhibitor (Yervoy® (ipilimumab)): Often used in combination with PD-1 inhibitors (e.g., Opdivo + Yervoy), this combo offers potent efficacy at the cost of higher toxicity, carving out a significant segment for high-need patients.

-

Future Wave: Next-generation immunotherapies like LAG-3 inhibitors (e.g., relatlimab, combined with nivolumab as Opdualag®) represent the new frontier, targeting different immune pathways to overcome resistance.

-

-

Targeted Therapy: A Precision Strike

-

BRAF/MEK Inhibitors: For the ~40-50% of patients with a BRAF V600 mutation, drugs like Tafinlar® (dabrafenib) + Mekinist® (trametinib) and Zelboraf® (vemurafenib) + Cotellic® (cobimetinib) offer rapid, high-response rates. However, acquired resistance remains a challenge, often sequencing these after or before immunotherapy.

-

-

Adjuvant & Neoadjuvant Therapy: Expanding the Addressable Patient Pool

A major growth driver is the use of these drugs in Stage II, III, and even earlier melanoma postsurgery to prevent recurrence. This dramatically expands the treatment duration and market size for these expensive therapies, a key commercial strategy for manufacturers.

Major Players and Competitive Dynamics

The market is oligopolistic, dominated by a few pharma giants:

-

Merck & Co. Maintains a leadership position with Keytruda, continually expanding its label into earlier stages.

-

Bristol-Myers Squibb (BMS) holds a strong portfolio with Opdivo, Yervoy, and Opdualag, offering a broad immunotherapy suite.

-

Novartis and Roche/Genentech lead the targeted therapy segment with their respective BRAF/MEK combinations.

-

Emerging Biotechs: Companies like Regeneron (with novel bispecific antibodies) and Iovance Biotherapeutics (with the first approved cell therapy, Amtagvi™ (lifileucel), for advanced melanoma) are introducing disruptive, niche modalities.

Competition is fierce, with ongoing head-to-head clinical trials comparing sequences and combinations to establish superiority in overall survival, durability of response, and safety.

Challenges and Market Restraints

-

High Cost of Therapy: Treatment can exceed $250,000 per year, placing immense burden on healthcare systems and limiting access in cost-sensitive markets.

-

Toxicity and Resistance: Immunotherapy can cause severe immune-related adverse events (irAEs), while targeted therapies often see relapse within a year.

-

Market Saturation in Advanced Lines: The largest unmet need is shifting to patients who have failed both immunotherapy and targeted therapy.

-

Complex Treatment Sequencing: Determining the optimal order of therapies (ICI first or targeted therapy first?) remains a clinical and commercial puzzle.

Future Outlook: Personalized and Combinatorial Approaches

The future of the melanoma market lies in:

-

Biomarker-Driven Treatment: Better identifying which patients will respond to which therapy, moving beyond just BRAF status to include tumor mutational burden (TMB), LAG-3 expression, and others.

-

Novel Combination Therapies: Merging ICIs with oncolytic viruses (e.g., Imlygic®), cancer vaccines, TIL therapy, and new checkpoint targets.

-

Focus on Brain Metastases: A historically difficult-to-treat area where new drug penetrance is critical.

-

Increased Focus on Access & Affordability: Pressure from payers and health technology assessments (HTAs) will drive outcomes-based pricing models and generic/biosimilar competition post-patent expiry later in the decade.

Read More-

https://www.zionmarketresearch.com/de/report/intravenous-infusion-pumps-market

https://www.zionmarketresearch.com/de/report/protein-supplements-market

https://www.zionmarketresearch.com/de/report/melanoma-drugs-market

https://www.zionmarketresearch.com/de/report/rodenticides-market

https://www.zionmarketresearch.com/de/report/barrier-resin-market

https://www.zionmarketresearch.com/de/report/fiberglass-sunscreen-market

Conclusion

The melanoma drugs market is a beacon of success in modern oncology, demonstrating how scientific innovation can radically alter a disease’s prognosis. While growth is assured by geographic expansion and earlier-stage treatment, the next phase will be defined by personalization, managing economic sustainability, and conquering the last frontiers of treatment resistance. For pharmaceutical companies, the race is no longer just for efficacy, but for delivering the right drug, to the right patient, at the right time in their journey.